Annual inflow of the Foreign Direct Investment (FDI) increased by around by around 4.40 per cent in the last calendar year, according to the latest data.

The central bank on Tuesday released the annual statistics of the FDI which showed that net inflow of FDI stood at US$2.33 billion in 2016 while the amount was $2.23 billion in 2015.

Usually, net inflow of FDI is derived by deducting the value of disinvestment from the gross inflow of FDI.

As gross FDI in the past year stood at $2.82 billion (or $2828.90 million), by deducting disinvestment worth $496.18 million, net inflow stood at $2332.72million (or $2.33 billion).

Bangladesh Bank has started calculating the net inflow of FDI in line with the sixth edition of the Balance of Payments (BoP) and International Investment Position Manual (BPM6) of the International Monetary Fund (IMF).

The components of disinvestment were capital repatriation and repayments of intra-company loans to foreign investors. Now, according to the BPM6 gauge, share of losses of foreign investors incurred by foreign-direct-investment enterprises is also included as a component of the disinvestment.

When contacted, Mr Azizul Islam, general manager of the statistics department of Bangladesh Bank said that the latest estimation was done following the BPM6 and so there was on inconsistency with the BoP data.

“The annual inflow of FDI in 2016 is now all time high in Bangladesh,” he said while talking with FE. “But, the amount is still low though the country is providing ample policy support to the foreign investors.”

He also said that the main reason for increase in FDI last year was due to fresh injection of capital by a mobile phone operator.

Of the three major components of FDI, investment through reinvested earnings of the existing Multinational Entities (MNEs) increased to $1215.59 million in the past year which was $1144.74 million in 2015.

Fresh investment or equity capital also increased to $911.38 million from $696.67 million during the period under review.

Intra-company loan, however, declined to $205.95 million in the past year from $393.95 million in 2015.

The central bank statistics also showed that last year highest amount of FDI came from Singapore which was $673.05 million.

In fact, Singapore Telecom (Singtel) in now the largest shareholder in Bharati Airtel which brought some $300 million in Bangladesh last to enhance the equity of Airtel in the country.

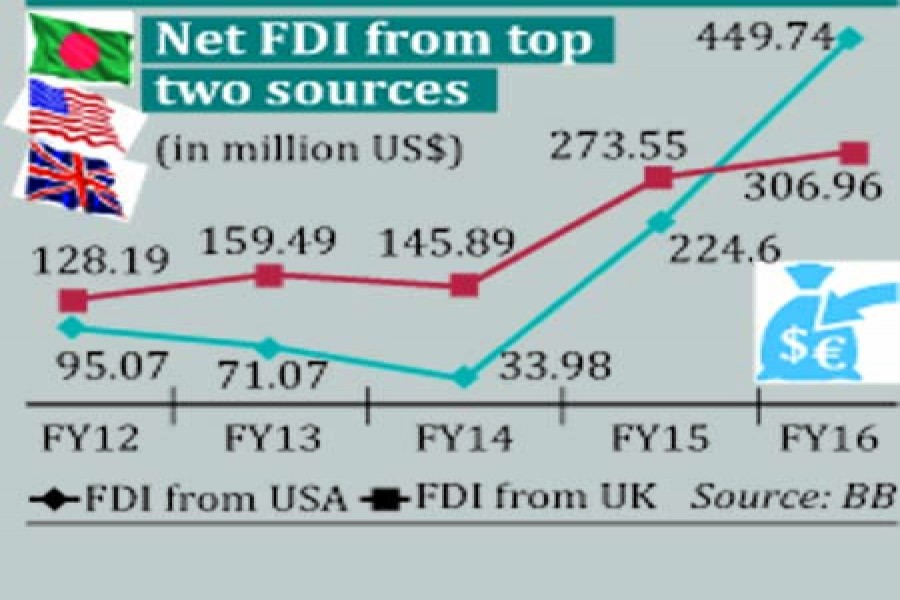

United Kingdom (UK) became the second largest source of FDI which brought some $330.32 million in last year followed by the United States (US) from where net inflow of FDI stood at 21.74 million.